miércoles, 31 de octubre de 2012

Earn SEC probes exchanges and electronic trading firms ties

Earn SEC probes exchanges and electronic trading firms ties (Reuters) - The U.S. Securities and Exchange Commission has launched a probe into the ties between stock exchanges and certain electronic trading firms, the Wall Street Journal reported on Saturday, citing people familiar with the matter. BATS Global Markets Inc, a U.S. exchange operator that is planning an initial public offering, said in a government filing cited by the Journal that it got a request from the U.S. regulator's enforcement division for information on the use of order types and its communications with certain market participants. The SEC also asked BATS for details about its information technology systems and trading strategies, the filing said. The inquiry also was examining communications BATS has with certain members affiliated with certain stockholders and directors, the paper reported. (Reporting By Debra Sherman in Chicago; Editing by Eric Beech)

lunes, 29 de octubre de 2012

Earn SEC probes exchanges and electronic trading firms ties

Earn SEC probes exchanges and electronic trading firms ties (Reuters) - The U.S. Securities and Exchange Commission has launched a probe into the ties between stock exchanges and certain electronic trading firms, the Wall Street Journal reported on Saturday, citing people familiar with the matter. BATS Global Markets Inc, a U.S. exchange operator that is planning an initial public offering, said in a government filing cited by the Journal that it got a request from the U.S. regulator's enforcement division for information on the use of order types and its communications with certain market participants. The SEC also asked BATS for details about its information technology systems and trading strategies, the filing said. The inquiry also was examining communications BATS has with certain members affiliated with certain stockholders and directors, the paper reported. (Reporting By Debra Sherman in Chicago; Editing by Eric Beech)

sábado, 27 de octubre de 2012

jueves, 25 de octubre de 2012

Signals Germany wants Greece to give up budget control

Signals Germany wants Greece to give up budget control RELATED QUOTES Symbol Price Change TRI 27.82 -0.10 Related Content A Greek national flag flies at the archaeological site of the Acropolis Hill in Athens November 3, 2011. REUTERS/John Kolesidis A Greek national flag flies at the archaeological site of the Acropolis Hill in Athens November 3, 2011. REUTERS/John Kolesidis By Noah Barkin BERLIN (Reuters) - Germany is pushing for Greece to relinquish control over its budget policy to European institutions as part of discussions over a second rescue package, a European source told Reuters on Friday. 'There are internal discussions within the Euro group and proposals, one of which comes from Germany, on how to constructively treat country aid programs that are continuously off track, whether this can simply be ignored or whether we say that's enough,' the source said. The source added that under the proposals European institutions already operating in Greece should be given 'certain decision-making powers' over fiscal policy. 'This could be carried out even more stringently through external expertise,' the source said. The Financial Times said it had obtained a copy of the proposal showing Germany wants a new euro zone 'budget commissioner' to have the power to veto budget decisions taken by the Greek government if they are not in line with targets set by international lenders. 'Given the disappointing compliance so far, Greece has to accept shifting budgetary sovereignty to the European level for a certain period of time,' the document said. Under the German plan, Athens would only be allowed to carry out normal state spending after servicing its debt, the FT said. 'If a future (bail-out) tranche is not disbursed, Greece cannot threaten its lenders with a default, but will instead have to accept further cuts in primary expenditures as the only possible consequence of any non-disbursement,' the FT quoted the document as saying. The German demands for greater control over Greek budget policy come amid intense talks to finalize a second 130 billion-euro rescue package for Greece, which has repeatedly failed to meet the fiscal targets set out for it by its international lenders. CHAOTIC DEFAULT THREAT Greece needs to strike a deal with creditors in the next couple of days to unlock its next aid package in order to avoid a chaotic default. 'No country has put forward such a proposal at the Eurogroup,' a Greek finance ministry official said on condition of anonymity, adding that the government would not formally comment on reports based on unnamed sources. The German demands are likely to prompt a strong reaction in Athens ahead of elections expected to take place in April. 'One of the ideas being discussed is to set up a clearly defined priorities on reducing deficits through legally binding guidelines,' the European source said. He added that in Greece the problem is that a lot of the budget-making process is done in a decentralized manner. 'Clearly defined, legally binding guidelines on that could lead to more coherence and make it easier to take decisions - and that would contribute to give a whole new dynamic to efforts to implement the program,' the source said. 'It is clear that talks on how to help Greece get back on the right track are continuing,' the source said. 'We're all striving to achieve a lasting stabilization of Greece,' he said. 'That's the focus of what all of us in Europe are working on right now.' (Reporting By Noah Barking; Additional reporting by George Georgiopoulos in Athens and; Adrian Croft in London; writing by Erik Kirschbaum; editing by Andrew Roche)

miércoles, 24 de octubre de 2012

Forex Top OTC/Pink Sheets Stock

Forex

| Top OTC/Pink Sheets Stocks - 9/11/12 | |||

| 1. Pristine Solutions (PRTN)2. Lifevantage Corporation (LFVN)3. Advanced Cell Technology Inc. (ACTC)4. Transax International Ltd. (TNSX)5. Cellceutix Corporation (CTIX)6. Southridge Enterprises Inc. (SRGE)7. MEDISAFE 1 TECHNOLOG (MFTH)8. Bebida Beverage Company, Inc. (BBDA)9. Punchline Resources Ltd. (PUNL)10. Oryon Technologies, Inc. (ORYN)11. Neologic Animation Inc. (NANI)12. OncoSec Medical Incorporated (ONCS)13. Eastman Kodak (EKDKQ)14. Fannie Mae (FNMA)15. Augme Technologies, Inc. (AUGT)16. AMR Corporation (AAMRQ)17. Save The World Air (ZERO)18. Sigma Labs, Inc. (SGLB) 19. Viking Minerals Inc. (VKMD)20. Fortune Oil & Gas, Inc. (FOGC)21. International Card Establishment Inc. (ICRD)22. Liberty Silver Corp. (LBSV)23. All American Pet Company, Inc. (AAPT)24. Imaging Diagnostic Systems Inc. (IMDS)25 Cannabis Science, Inc. (CBIS)26. Worthington Energy, Inc. (WGAS)27. Stevia First Corp (STVF)28. Dynamic Ventures Corporation (DYNV)29. Chimera Energy Corporation (CHMR)30. Vision Plasma Systems (VLNX)31. Everybody's Phone Company (EVPH)32. Medical Marijuana, Inc. (MJNA)33. Firemans Contractors, Inc. (FRCN)34. Applied DNA Sciences Inc. (APDN)35. Globalgroup Investment (GIHI)36. Freddie Mac (FMCC)37. Liquidmetal Technologies Inc. (LQMT)38. Entest Biomedical, Inc. (ENTB)39. Lynas Corporation Limited (LYSCF)40. Life Design Station International, Inc. (LDSI)41. Patriot Coal (PCXCQ)42. Implant Sciences Corp. (IMSC)43. NeoMedia Technologies Inc. (NEOM)44. Fuse Science, Inc. (DROP)45. Global Karaoke Network, Inc. (GKNI)46. Rapid Fire Marketing, Inc. (RFMK)47. Todays Alternative Energy Corporation (TAEC)48. Pacific Gold Corp (PCFG)49. Aperture Health, Inc (APRE)50. Domark Intl (DOMK)51. F-3 Technologies, Inc. (FTCH)52. SEFE, Inc. (SEFE)53. AmBase Corp. (ABCP)54. American Diversified Holdings Corporation (ADHC)55. Stevia Corp. (STEV)56. KMA Global Solutions (KMAG)57. Organovo Holdings, Inc. (ONVO)58. ATTITUDE DRINKS INC (ATTD)59. NaturalNano, Inc. (NNAN)60. Dig-It Underground, Inc. (DIGX)61. DNA Dynamics, Inc. (DNAD)62. Tactical Air Defense Services, Inc. (TADF)63. Platforms Wireless International Corp. (PLFM)64. Agent155 Media Corp. (AGMC)65. Revolutionary Concepts, Inc. (REVO)66. WrapMail, Inc. (WRAP)67. Herborium Group, Inc. (HBRM)68. Cytomedix, Inc. (CMXI)69. InVivo Therapeutics Holdings Corp. (NVIV)70. mPhase Technologies, Inc. (XDSL.OB)71. U.S. Silver Corporation (USSIF)72. Delta Petroleum Corp (DPTRQ.PK)73. Sebastian River Holdings, Inc. (SBRH)74. ADM Tronics Unlimited Inc. (ADMT)75. Friendly Energy Exploration (FEGR)76. Far East Energy Corp (FEEC.OB)77. AGR Tools, Inc. (AGRT.PK)78. West Canyon Energy Corp. (WCYN)79. Liberty Star Uranium & Metals Corp. (LBSR)80. Green Oasis Environmental, Inc. (GRNO.PK)81. VGTEL, INC. (VGTL.PK)82. CDC CORP (CDCAQ.PK)83. Propell Corporation (PROP)84. SATYAM COMPUTER SERVICES LTD (SAYCY.PK)85. Nuvilex, Inc. (NVLX.PK)86. Quantum International Corp. (QUAN)87. PeopleString Corporation (PLPE.OB)88. Trycera Financial, Inc. (TRYF.PK)89. DiMi Telematics International, Inc. (DIMI)90. Vitro Diagnostics, Inc. (VODG.PK)91. Flameret, Inc. (FLRE.PK)92. American Medical Technologies Inc. (ADLI)93. First China Pharmaceutical Group, Inc. (FCPG.OB) | |||

| 94. Earth Dragon Resources Inc. (EARH.OB) | |||

| 95. Inolife Technologies, Inc. (INOL.PK)96. Sunrise Consulting Group, Inc. (SNRS.PK) | |||

| 97. Spoofem.com USA (SPFM.PK) | |||

| 98. WRITERS GROUP FILM CORP (WRIT)99. JBI, Inc. (JBII.PK)100. Boreal Water Collection, Inc. (BRWC.PK)101. Home Energy Savings Corp. (HESV.PK) | |||

| 102. AppTech Corp. (APCX.PK) | |||

| 103. Ramoil Management, Ltd. (RAMO.PK) | |||

| 104. Metatron Inc. (MRNJ.PK) | |||

| 105. Kalahari Greentech, Inc. (KHGT.PK) | |||

| 106. Neoprobe Corp. (NEOP.OB) | |||

| 107. Vitesse Semiconductor Corp. (VTSS.PK) | |||

| 108. Titan Resources International Corp. (TNRI.PK) | |||

| 109. EMAMBA INTL CORP (EMBA.PK)110. CROSSWIND RENEWABLE (CWNR.PK)111. MARIJUANA, INC. (HEMP.PK)112. AISystems, Inc. (ASYI.PK)113. Angiotech Pharmaceuticals Inc. (ANPI)(ANPI.PK)114. Seahawk Drilling, Inc. (HAWK) (HAWKQ.PK) | |||

| 115. Razor Resources Inc. (RZOR.OB) | |||

| 116. Quest Rare Minerals Ltd. (QSURD.PK) | |||

| 117. RegenoCell Therapeutics, Inc. (RCLL.OB)118. Action Products International, Inc. (APII.PK)119. EXPLORE ANYWHERE HOLDINGS (EAHC)120. RINO International Corporation (RINO.PK) | |||

| 121. ALL AMERICAN GOLD CORP (AAGC.OB)122. Talon Therapeutics, Inc. (TLON)123. Novadel Pharma Inc. (NVDL.OB)124. CYOP SYSTEMS INTL (CYOS.PK)125. Garb-Oil & Power Corp. (GARB.PK)126. Hi Score Corp. (HSCO)127. Terralene Fuels Corporation (GSPT)128. Deltron Inc. (DTRO.OB)129. STANS ENERGY CORP (STZYF.PK) | |||

| 130. Globetrac Inc. (GBTR.PK) | |||

| 131. HELICOS BIOSCIENCES (HLCS.PK) | |||

| 132. Genta Incorporated (GETA.OB) | |||

| 133. eDOORWAYS Corporation (EDWY.PK) | |||

| 134. Searchlight Minerals Corp. (SRCH.OB)135. Global Health Ventures, Inc. (GHLV.PK) | |||

| 136. PARAFIN CORP (PFNO.PK)137. RTG Ventures Inc. (RTGV.PK)138. International Stem Cell Corporation (ISCO.OB)139. San West, Inc. (SNWT.OB)140. ALR Technologies Inc. (ALRT.OB)141. Dutch Gold Resources, Inc. (DGRI.PK)142. China Wi-Max Communications, Inc. (CHWM.OB)143. Luke Entertainment, Inc. (LKEN.PK)144. iBrands Corp (IBRC.PK)145. Andes Gold Corp (AGCZ.PK)146. Lithium Corporation (LTUM.OB)147. Medical Staffing Solutions Inc. (MSSI)148. SunPeaks Ventures (SNPK)149. Toron, Inc. (TRON.OB)150. EPUNK, INC. (PUNK.PK)151. Cougar Oil and Gas Canada Inc. (COUGF.OB) | |||

| 152. Silver Falcon Mining, Inc. (SFMI)153. Guided Therapeutics, Inc (GTHP)154. Luxeyard, Inc. (LUXR)155. Talisman Holdings, Inc. (TMHO.PK) | |||

| 156. MediSwipe, Inc. (MWIP.OB)157. China Nuvo Solar Energy, Inc. (CNUV.PK)158. Pershing Gold Corp (PGLC.OB)159. AVATAR VENTURES CORP (AVVC.OB) | |||

| 160. BRAZOS INTERNATIONAL EXPLORATION, INC (BRZL.PK) | |||

| 161. Northwest Biotherapeutics, Inc. (NWBO)162. eMax Holdings Corp. (EMXC.PK)163. TRANZBYTE CORPORATIO (ERBB.PK)164. China Tel Group Inc. (CHTL.OB) | |||

| 165. Lyric Jeans, Inc. (LYJN.PK)166. Reeltime Rentals, Inc. (RLTR.PK) | |||

| 167. Valcom, Inc. (VLCO.PK)168. Easton Pharmaceuticals Inc. (EAPH.PK)169. Simulated Environment Concepts, Inc. (SMEV.PK)170. Beyond Commerce, Inc. (BYOC.OB)171. AquaStar Holdings, Inc. (RPPR.PK) | |||

| 172. Optical Systems, Inc. (OPSY.PK)173. NIKRON TECHNOLOGIES (NKRN.PK)174. BioPharm Asia Inc. (BFAR.PK) | |||

| 175. XcelMobility Inc. (XCLL.OB)176. Healthy Coffee International, Inc. (HCEI.PK) | |||

| 177. A-Power Energy Generation Systems (APWR.PK)178. Proteonomix, Inc. (PROT.OB)179. Lighthouse Petroleum, Inc. (LHPT.PK)180. Mammoth Energy Group, Inc. (MMTE.PK)181. Comverse Technology Inc. (CMVT.PK)182. Encounter Technologies, Inc. (ENTI.PK) | |||

| 183. Li-ion Motors Corp. (LMCO.OB)184. Western Sierra Mining Corp. (WSRA.PK) | |||

| 185. Cotton & Western Mining, Inc. (CWRN.PK) | |||

| 186. Titan Energy Worldwide, Inc. (TEWI)187. SIPP International Industries, Inc (SIPN.PK)188. Vega Biofuels, Inc. (VGPR.PK) | |||

| 189. Intellect Neurosciences, Inc. (ILNS)190. American Community Development Group Inc. (ACYD)191. Shamika 2 Gold, Inc. (SHMX.OB)192. Power Technology Inc. (PWTC.PK)193. Diamond Information Institute, Inc. (DIII.PK)194. Lone Star Gold, Inc. (LSTG.OB)195. High Plains Gas, Incorporated (HPGS.OB)196. Genius Brands International, Inc. (GNUS)197. Tuffnell Ltd. (TUFF.OB) | |||

| 198. Total Apparel Group, Inc. (TLAG.PK) | |||

| 199. Avalon Oil and Gas, Inc. (AOGN.PK)200. Liberty Coal Energy Corp. (LBTG.OB) | |||

| 201. Thornburg Mortgage Inc. (THMRQ.PK) | |||

| 202. Oteegee Innovations, Inc. (OTGI.PK) | |||

| 203. Sunergy Inc. (SNEY.PK) | |||

| 204. Fresh Start Private Management Inc. (CEYY.OB) | |||

| 205. Marketing Worldwide Corp (MWWC.PK)206. VisualMED Clinical Solutions Corp. (VMCS.PK)207. China YiBai United Guarantee International Holding Inc. (CBGH.PK)208. Titan Oil & Gas, Inc. (TNGS.OB) | |||

| 209. LEGEND OIL & GAS (LOGL.OB)210. China Carbon Graphite Group, Inc. (CHGI.OB) | |||

| 211. American Lithium Minerals Inc. (AMLM.OB) | |||

| 212. All Grade Mining, Inc. (HYII.PK)213. Li3 Energy, Inc. (LIEG.OB) | |||

| 214. Gryphon Resources, Inc. (GRYO.PK) | |||

| 215. America Fiber Green Products (AFBG.PK)216. Alamo Energy Corp. (ALME.OB) | |||

| 217. California Gold Corp (CLGL)218. Anything Technologies Media Inc. (EXMT.PK)219. Ameriwest Energy Corp. (AWEC.PK)220. Washington Mutual Inc. (WAMUQ.PK)221. Ranger Gold Corp. (RNGC.OB) | |||

| 222. SpectrumDNA, Inc. (SPXA.PK) | |||

| 223. Westmont Resources Inc. (WMNS.PK) | |||

| 224. Echo Therapeutics, Inc. (ECTE.OB) | |||

| 225. Hop-On Inc. (HPNN.PK) | |||

| 226. 3D Icon Corporation (TDCP.OB) | |||

| 227. Singing Machine Company, Inc. (SMDM)228. El Maniel International, Inc. (EMLL.PK)229. Dussault Apparel, Inc. (DUSS.PK)230. W2 Energy Inc. (WTWO)231. My Social Income, Inc. (MSOA.PK)232. Hiru Corporation (HIRU.PK) | |||

| 233. Prime Sun Power Inc. (PSPW.OB) | |||

| 234. CrowdGather, Inc. (CRWG.OB)235. Ecosphere Technologies, Inc. (ESPH.OB) | |||

| 236. Savoy Energy Corp (SNVP.PK)237. China MediaExpress Holdings, Inc. (CCME.PK) | |||

| 238. HELIX WIND CORP (HLXW.PK)239. Easylink Solutions Corp. (ESYL.PK)240. Elephant Talk Communications Inc. (ETAK.OB)241. EcoloCap Solutions Inc. (ECOS.OB)242. Next 1 Interactive Inc. (NXOI.OB)243. Mistral Ventures Inc. (MILV.PK)244. CLEAN POWER CONCEPTS (CPOW.PK)245. CROWNE VENTURES INC (CRWV.PK)246. HORIYOSHI WORLDWIDE (HHWW.OB)247. DPOLLUTION International Inc. (RMGX.PK) | |||

| 248. Global Developments, Inc. (GDVM.PK)249. Allezoe Medical Holdings, Inc. (ALZM)250. Abot Mining Co. (ABOT.PK)251. Yippy, Inc. (YIPI)252 Globalink Ltd. (GOBK)253. BioElectronics Corporation (BIEL.PK)254. BizRocket.com, Inc. (BZRT)255. KAT Exploration Inc. (KATX.PK)256. ShengdaTech, Inc. (SDTHQ.PK)257. Bioflamex Corp (BFLX)258. GENEREX BIOTECH CORP (GNBT.PK)259. Leo Motors Inc. (LEOM)260. EVCARCO, Inc. (EVCA.OB)261. Imaging3 Inc. (IMGG.OB)262. China Electric Motor, Inc. (CELM.PK)263. Coastal Pacific Mining Corp. (CPMCF.PK) | |||

| 264. Dog, Inc. (GRDO.PK) | |||

| 265. Tirex Corp. (TXMC.PK)266. ZAP (ZAAP.OB)267. Li3 Energy, Inc. (LIEG.OB)268. Left Behind Games Inc. (LFBG.OB)269. Lattice Incorporated (LTTC)270. TERRESTAR CORP (TSTRQ.PK)271. Societe Generale (SCGLY.PK)272. Global Digital Solutions (GDSI.PK)273. AER Energy Resources, Inc (AERN.PK)274. LTS Nutraceuticals, Inc. (LTSN.OB)275. Bryn Resources, Inc. (BRYN.PK)276. For the Earth Corp (FTEG.PK)277. THE BRAINY BRANDS (TBBC.OB)278. Sweetwater Resources, Inc. (SWTR)279. GoIP Global, Inc. (GOIG.PK)280. RXi Pharmaceuticals Corporation (RXII)281. Cannabis Medical Solutions, Inc. (CMSI.OB)282. Unilava Corporation (UNLA)283. North Springs Resources Corp. (NSRS.OB)284. California Grapes International, Inc. (CAGR.PK)285. Kunekt Corporation (KNKT.PK)286. PUDA Coal (PUDA.PK)287. EAST COAST DIVERSIFIED (ECDC)288. OriginOil, Inc. (OOIL.OB)289. Kurrant Mobile Catering, Inc. (KRMC.OB)290. Global Gaming Network Inc. (GBGM)291. Cytosorbents Corporation (CTSO)292. Location Based Technologies, Inc. (LBAS.OB)293. Beneficial Holdings, Inc. (BFHJ.PK)294. PURESPECTRUM, INC (PSRU.PK)295. Immunovative, Inc. (IMUN)296. Marine Drive Mobile Corp. (MDMC)297. Onteco Corp (ONTC)298. Cord Blood America Inc. (CBAI)299. HDS International Corp (HDSI.PK)300. Amerilithium Corp. (AMEL.OB)301. Ingen Technologies, Inc. (IGNT)302. Union Equity (UNQT.PK)303. Omni Ventures, Inc. (OMVE)304. Genta Inc. (GNTA.OB)305. CMG Holdings, Inc. (CMGO)306. Atlas Technology Group, Inc. (ATYG.PK)307. Smokefree Innotec, Inc. (SFIO.PK)308. Brainstorm Cell Therapeutics Inc. (BCLI.OB)309. Solos Endoscopy, Inc. (SNDY)310. Majic Wheels Corp. (MJWL)311. Converted Organics Inc. (COIN)312. Zann Corp. (ZNNC)313. MusclePharm Corp. (MSLP)314. IDO Security Inc. (IDOI)315. Iconic Brands, Inc. (ICNB)316. Speedemissions Inc. (SPMI)317. E-Waste Systems, Inc. (EWSI)318. GREEN TECH SOLUTIONS (GTSO)319. NanoViricides, Inc. (NNVC)320. Sarissa Resources, Inc. (SRSR)321. Hollund Industrial Marine, Inc. (HIMR)322. ALPHA WASTEWATER INC (AWWI)323. WebSafety, Inc. (WBSI)324. Emperial Americas, Inc. (TEXX)325. LITHIUM EXPLORATION (LEXG.OB)326. Sky Power Solutions Corp. (SPOW)327. EL CAPITAN PRECIOUS METALS INC (ECPN)328. Sutimco International (SUTI)329. Nouveau Life Pharmaceuticals, Inc. (NOUV)330. HST Global, Inc. (HSTC)331. Centaurus Diamond Technologies, Inc. (CTDT)332. Options Media Group Holdings, Inc. (OPMG.PK)333. MF Global (MF) (MFGLQ.PK)334. Treaty Energy Corporation (TECO.PK)335. PORTAGE RESOURCES (POTG.PK)336. RightSmile, Inc. (RIGH.PK)337. Viking Systems, Inc. (VKNG)338. Active Health Foods, Inc. (AHFD)339. Lighting Science Group Corporation (LSCG)340. Titan Pharmaceuticals Inc. (TTNP.OB)341. Jammin Java Corp. (JAMN.OB)342. Minera Andes Inc. (MNEAF.OB)343. The Graystone Company, Inc. (GYST)344. Great Wall Builders Ltd. (GWBU)345. Suspect Detection Systems Inc. (SDSS)346. Vidable, Inc. (VIBE)347. CHINA INTEGRATED ENERGY (CBEH.PK)348. First Liberty Power Corp. (FLPC)349. Caduceus Software Systems Corp. (CSOC.OB)350. Cooper Holding Corp. (COHO)351. Cono Italiano, Inc. (CNOZ.OB)352. Virogen Inc (VRNI.PK)353. Elite Pharmaceuticals Inc. (ELTP.OB)354. Valence Technology Inc. (VLNCQ)355. HyperSolar, Inc. (HYSR)356. Thwapr, Inc. (THWI.OB)357. Ants Software (ANTS.PK)358. American Scientific Resources, Inc. (ASFX.OB)359. Dune Energy Inc. (DUNR.OB)360. Aqualiv Technologies, Inc. (AQLV.OB)361. Medinah Minerals Inc. (MDMN)362. Toron, Inc. (TRON)363. A Clean Slate, Inc. (DRWN)364. Grid Petroleum Corp. (GRPR.OB)365. NYXIO TECH CORP (NYXO.PK)366. IntelGenx Technologies Corp. (IGXT.OB)367. Carbon Sciences, Inc. (CABN)368. Baristas Coffee Company Inc. (BCCI.PK)369. RADIENT PHARMACEUTICALS CORP (RXPC.PK)370. Amwest Imaging Incorporated (AMWI.OB)371. Soligenix, Inc. (SNGX.OB)372. Molecular Pharmacology (USA) Ltd. (MLPH)373. Sunvalley Solar, Inc. (SSOL.OB)374. Energy 1 Corp. (EGOC.PK)375. National Automation Services, Inc. (NASV.PK)376. Mustang Alliances (MSTG.OB)377. Bioheart, Inc. (BHRT.OB)378. SINO PAYMENTS, INC. (SNPY.PK)379. RAYSTREAM INC (RAYS.OB)380. XNE, INC (XNEZ.PK)381. Evergreen Energy, Inc. (EVEI.OB)382. Medinah Minerals Inc. (MDMN.PK)383. AL International, Inc. (JCOF.PK)384. CITY CAPITAL CP (CTCC.PK)385. Legends Business Group Inc. (LGBS)386. Medinah Minerals Inc. (MDMN)387. CUBA Beverage Company (CUBV)388. Freedom Energy Holdings (FDMK.PK)389. Gear International Inc. (GEAR.PK)390. Marina Biotech, Inc. (MRNA.PK)391. Itonis Inc. (ITNS.PK)392. Clean Coal Technologies (CCTC.PK)393. Optex Systems Holdings, Inc (OPXS)394. Uranium Hunter Corporation (URHN)395. Mike the Pike Productions, Inc. (MIKP)396. Myriad Interactive Media, Inc. (MYRY)397. Green Energy Renewable Solutions, Inc. (EWRL)398. Delta Oil & Gas Inc. (DLTA)399. Media Sentiment, Inc. (MSEZ.PK)400. Advanced Battery Technologies, (ABAT.PK)401. American Liberty Petroleum (OREO)402. Nephros Inc. (NEPH.OB)403. Rackwise, Inc. (RACK.OB)404. US Energy Initiatives Corporation. (USEI.PK)405. Independence Energy Corp. (IDNGD)406. Bourque Industries, Inc. (BORK.PK)407. Cleantech Transit, Inc. (CLNO)408. Atrinsic, Inc. (ATRNQ)409. IC PLACES, INC. (ICPA)410. Neogenomics Inc. (NGNM)) | |||

martes, 23 de octubre de 2012

Forex End of day fade

Forex

For 2 days in a row we had end of day fades . That is not a good sign.

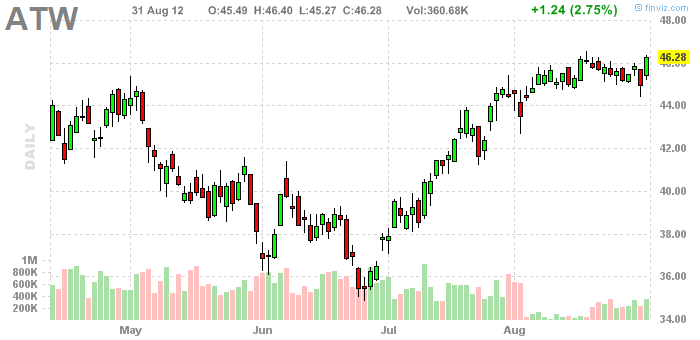

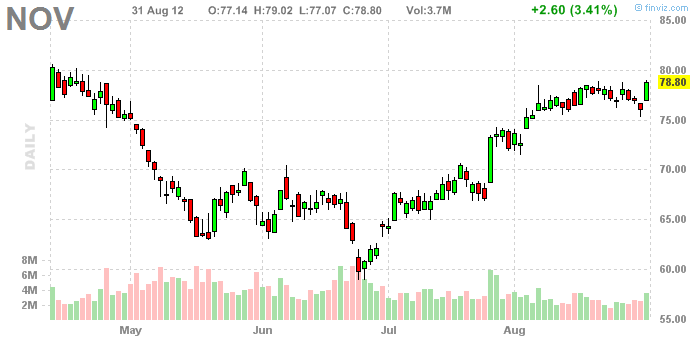

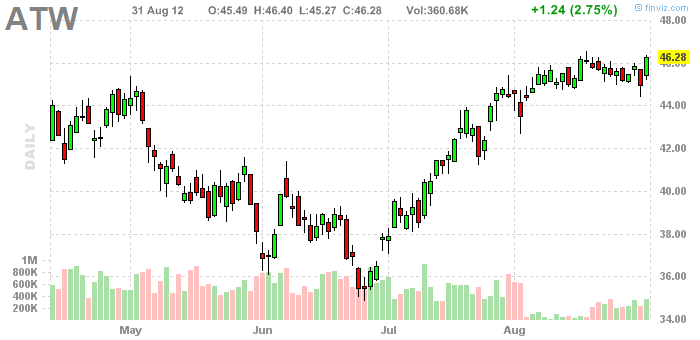

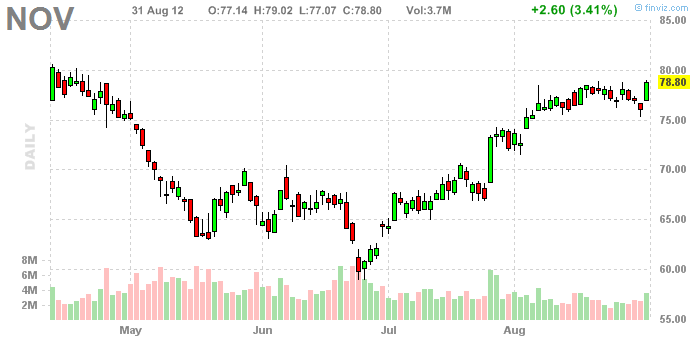

The underlying breadth is good , but a little more conviction is needed. The action on individual stocks looks attractive. Number of them are breaking out on good volume. The oil and gas stocks have had best month or so .

The international market ETF have found a bid and many of them had huge moves in last 5 days.

The underlying breadth is good , but a little more conviction is needed. The action on individual stocks looks attractive. Number of them are breaking out on good volume. The oil and gas stocks have had best month or so .

The international market ETF have found a bid and many of them had huge moves in last 5 days.

lunes, 22 de octubre de 2012

Oil Swing trading opportunities

Oil

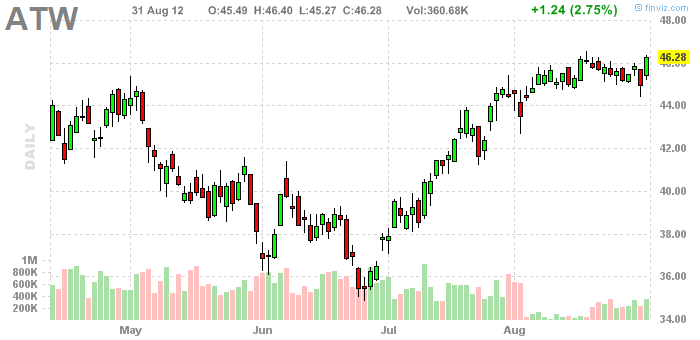

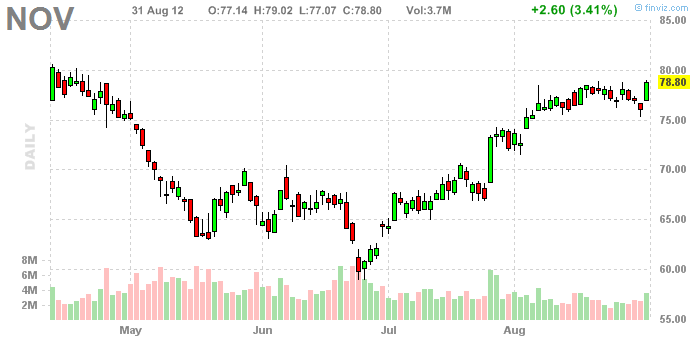

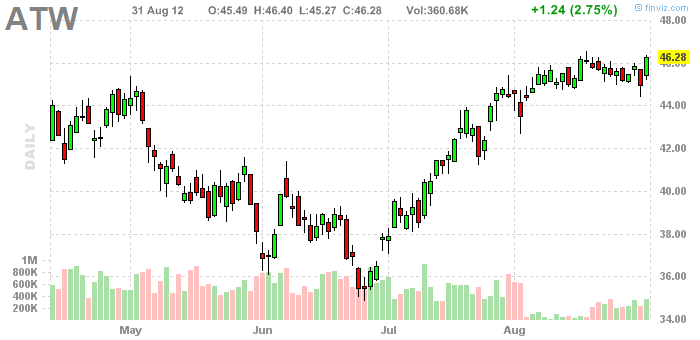

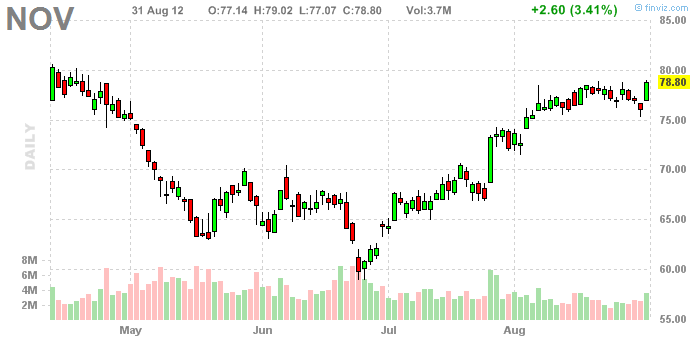

Several stocks are breaking out and there are some nice setups showing up in our scans. Many stocks are going sideways during market consolidation and are now breaking out.

domingo, 21 de octubre de 2012

Earn Swing trading opportunities

Earn

Several stocks are breaking out and there are some nice setups showing up in our scans. Many stocks are going sideways during market consolidation and are now breaking out.

jueves, 18 de octubre de 2012

Forex Etisalat eyes mobile remittances in Gulf

Forex Etisalat eyes mobile remittances in Gulf Companies: AFN RELATED QUOTES Symbol Price Change AFN 0.00 0.00 Related Content A man walks past a sign at the headquarters of telecommunications company Etisalat in Dubai October 25, 2011. REUTERS/Jumana El HelouehView Photo A man walks past a sign at the headquarters of telecommunications company Etisalat in Dubai October 25, 2011. REUTERS/Jumana El Heloueh By Matt Smith DUBAI (Reuters) - UAE telecoms operator Etisalat (ABD:ETISALAT), which saw $1.8 billion moved over its network last year via money transfers, has sought regulatory approval to expand its financial services offerings in the Gulf region, home to millions of expatriates. Mobile money services allow customers to pay bills or make remittances using SMS text messages, often at a cheaper cost than through banks or money transfer firms. 'Remittances are a huge business opportunity,' George Held, director of products and services at Etisalat, told Reuters. 'The cost base for telecoms operators is much different than for banks and exchange houses. We do not need bricks and mortar branches, so our costs are lower and we can pass on this saving and offer better exchange rates and transaction fees.' The former monopoly was expected to focus on its home market and Saudi Arabia. Both countries have large expat populations and inbound annual remittances were worth about $36 billion combined in 2010, Held said. About 89 percent of the UAE's 8.3 million population are expatriates, while in Saudi Arabia just over a fifth of the 27 million population are foreigners. Etisalat's Egypt unit could also profit from an estimated $8 billion of inbound remittances from Egyptians working abroad. Etisalat has tied up with Western Union and MoneyGram International to allow money sent by mobile customers in the Middle East to be collected anywhere in the world. Aside from remittances, the operator hopes to offer salary payments, peer-to-peer domestic funds transfers and utility and shop payments. 'Remittances will be an extremely important part of our mobile money services. But it is not enough alone to drive service adoption, so we will offer a mix of services to make it very hard for customers not to get involved,' said Held. Etisalat already offers some of these services in six countries, including Afghanistan, Pakistan, Sri Lanka and Tanzania and plans to expand this to the 17 countries in which it operates in Asia, Africa and the Middle East. 'We want to introduce mobile money in the rest of our markets as soon as possible. It is not a technical issue, but ticking all the boxes from a regulatory, compliance and customer education point of view,' Held said. LESS MONEY, MORE LOYALTY Mobile money has taken off in parts of Africa, where a minority of people hold bank accounts and the banking infrastructure in rural areas remains limited. About 8 percent of Tanzania's gross domestic product is thought to go through mobile banking. Text-based financial services will not help stem a decline in global SMS revenues - seen dropping up to 40 percent over the next three years as users opt for alternative text services such as BlackBerry Messenger or WhatsApp - but it can improve customer loyalty. 'When people have a mobile wallet ... we believe they will stay with us for a long time,' Held said. 'When was the last time you changed your bank account?' Etisalat will face challenges in convincing customers in the Gulf region, who have easy access to banking and exchange houses, to switch. 'In this region, people are used to going to the bank for transactions - they like to get a receipt. It is not a game-changer for telecom operators' revenues,' said a regional telecoms analyst. Pedro Oliveira, partner at consultant Oliver Wyman, said telecoms operators face a tough task competing with conventional exchange houses. 'Low income workers in the Gulf count every penny. So, it is not convenience that matters, but cost,' he said. 'For expats with prepaid contracts wanting to send money home, they would have to buy prepaid cards to top up their phone balance and then send a text.'

lunes, 15 de octubre de 2012

Signals Analysis: Oil price rise raises specter of global recession

Signals Analysis: Oil price rise raises specter of global recession LONDON (Reuters) - A jump in energy prices is jamming the slow-turning cogs of an economic recovery in the West, but that may be nothing compared to the economic shock an Israeli attack on Iran would cause. Oil rose to a 10-month high above $125 a barrel Friday, prompting responses from policymakers around the world including U.S. President Barack Obama, watching U.S. gasoline prices follow crude to push toward $4 a gallon in an election year. Europe may have more to fear as its fragile economic growth falters and Greece, Italy and Spain look for alternative sources to the crude they currently import from Iran, where an EU oil embargo, intended to make Iran abandon what the West fears are efforts to develop nuclear weapons, comes into force in June. In euro terms, Brent crude rose to an all-time high of 93.60 euros this week, topping its 2008 record. 'The West's determination to prevent Iran acquiring nuclear weapons is coming at a price - a price that might include a second global recession triggered by an oil shock,' said David Hufton from the oil brokerage PVM. In dollar terms, oil prices are still some $20 a barrel short of their 2008 record of $147. But the latest Reuters monthly survey will Monday show oil analysts revising up their predictions for Brent crude by $3 since the previous month. Such a change is big in a poll of over 30 analysts, and last happened at the peak of the Libyan war in May. Ian Taylor, head of the world's biggest oil trading house Vitol, told Reuters this week prices could spike as high as $150 a barrel if Iran's arch-enemy Israel launched a strike at its nuclear facilities - an option Israel has declined to rule out. 'I used to think this would never happen,' Taylor said, 'but everyone you speak to says the Israelis will have a go at striking at Iranian nuclear sites. 'The day that happens, you have to believe the Iranians throw a few mines in the Strait of Hormuz and, for a few hours at least or maybe more, I cannot see a scenario where prices would not be at that sort of level ($150).' The U.N. nuclear watchdog said Friday Iran had sharply stepped up its uranium enrichment, which Iran insists is solely for civilian purposes. Israel has warned that, by putting much of its nuclear program underground, Iran is approaching a 'zone of immunity,' but it has also said any decision to attack is 'very far off.' Wall Street bank Merrill Lynch said this week that oil prices could climb to $200 over the next five years. ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> So far this year, dollar prices for Brent crude have risen by more than 15 percent, pushed up mainly by fears about Iran. The loss of supply from three small and mid-sized producers suffering internal turmoil - Syria, Yemen and South Sudan - has added to the supply worries. WEAK GROWTH, HIGH PRICES A stabilization of the U.S. economy may explain some of the rise in oil prices, but the global economy is growing far more slowly now than at this time last year, yet crude prices are just as high. World equities and oil have typically been closely correlated since 2008 because both were driven by global demand. However, as oil prices start to respond to supply problems, the correlation is evaporating, and the global economy is already paying a high price. Data published this week showed unexpectedly weak activity in Europe's most powerful economy, Germany, and in France, sparking fresh worries that the region could tip into recession. Few have forgotten that in 2008, within six months of hitting its all-time high, oil plunged as low as $35 a barrel with the onset of the global credit crisis. In the United States, demand for refined oil products is close to its lowest level in nearly 15 years, indicating that motorists are cutting back their mileage. 'The price spike is going to be a challenge for politicians in the West running for re-election,' said Olivier Jakob from the Petromatrix consultancy. He said developed countries would find it hard to justify a release of strategic oil stocks similar to what they did in 2011. Unlike a year ago, when Libyan oil exports were disrupted by a war, this year 'there is ... instead a voluntary restriction on buying from a specific country,' said Jakob. Other than a release of oil stocks, developed countries could resort to yet another round of monetary easing, to which emerging markets will respond with quantitative tightening, price controls and subsidies, said analysts from HSBC. 'In terms of fiscal health, it would seem that Asia is better placed than other regions to deal with an oil price shock,' HSBC said in a note last week.

Signals Is the Euro Decoupling From U.S. Stocks?

Signals Is the Euro Decoupling From U.S. Stocks? Companies: EUR/USD S&P 500 NASDAQ Composite RELATED QUOTES Symbol Price Change EURUSD=X 1.2832 +0.0123 ^GSPC 1,291.87 -0.61 ^IXIC 2,715.73 +4.97 ^DJI 12,432.35 -17.10 FXE 127.78 +1.22 For much of the last 15 years the S&P 500 and euro (the EU currency) have been moving in the same direction. Since its May 4, 2011 high (the euro topped two days after U.S. stocks) the euro has tumbled 15%. Worse yet, the euro has been falling over the past few weeks even though the S&P has remained stable. Will the S&P soon catch up with the euro, or is the euro about to decouple its positive correlation with U.S. equities? Euro Problems Euro problems are the reason for the bad euro season. U.S. stocks got to enjoy the Santa Claus Rally while the euro was stuck with debt concerns that include: - Eurozone governments need to refinance more than $1.3 trillion in debt in 2012. - Yields on Italian bonds crept up about 7% again (above 7% yields send Greece into a tailspin). - Standard & Poor's is expected to strip France of its AAA rating as early as this month. - Spain's banks need to raise an extra $65 billion to cover bad property loans. - In February, Italy needs to sell more debt than could be covered even if investors used all the proceeds of maturing securities to buy the bonds. Euro Hope Things are so bad for the euro (EURUSD=X), they are good. So it seems at least. The chart below shows the euro holdings of the 'smart' and 'dumb' money published by the Commodity Futures Trading Commission. The first gray graph shows total non-reportable short positions. Non-reportable are small traders considered the dumb money. The second gray graph shows reportable commercial short positions. Commercial traders are the 'pros' that actually provide a commodity or instrument and are considered the smart money. The data shows that non-reportable short positions are pretty high right now (data as of Tuesday) while commercial traders have closed nearly all their short positions. Based on COT sentiment data, the euro should be close to a bottom, at least a temporary one. Cause for U.S. Stock Rally? But wouldn't a rising euro translate into rising U.S. stocks? Under normal circumstances, yes it would. A look at the chart below shows that a rising euro usually correlates with a rising S&P 500. The red boxes highlight periods of falling euro and rising S&P (such as lately). The green box identifies a period of time when a rising euro (NYSEArca: FXE - News) coincided with falling (even rapidly falling) U.S. stock prices. This happened from October 2007 - July 2008. Putting Odds in Your Favor It's no secret that I declared the rally from the October lows to be a counter trend rally. Back on October 2, I stated via the ETF Profit Strategy updated that: 'I don't think October will 'kill' this bear market, but it should spur a powerful counter trend rally. Towards the end of this rally Wall Street may applaud the Fed for launching Operation Twist and QE3 may be considered unnecessary. This kind of positive environment would be fertile soil for the next bear market leg (Q1 or Q2 2012). From a technical point of view this counter trend rally should end somewhere around 1,275 - 1,300.' To identify high-probability trade setups, I like to see technicals, sentiment, and seasonality point in the same direction, such as they did in early October. From a seasonal perspective, October has the reputation of a 'bear market killer.' Sentiment polls showed the most bearish readings in over a year and the VIX (Chicago Options: ^VIX) was close to the 2010 high. At the same time, the S&P had reached rock bottom support. Based on the weight of evidence, the October 2 ETF Profit Strategy update also predicted that: 'The ideal market bottom would see the S&P dip below 1,088 intraday followed by a strong recovery and a close above 1,088.' On October 4, the S&P briefly dipped below 1,088 and closed the day at 1,124. A massive counter trend rally was born that day. The Next Setup? Seasonality is once again turning bearish (or at the very least less bullish). Since 2002, the S&P reached a January top followed by a drop greater than 8% five (out of ten) times. 51.1% of all investment advisors and newsletter-writing colleagues (polled by II) are bullish on stocks (the highest reading since May 3) while only 17% of individual investors (polled by AAII) are bearish, the second lowest reading in six years. From a technical point of view, the S&P (SNP: ^GSPC - News) is about to reach a daunting resistance cluster comprised of Fibonacci levels and various long and short-term trend lines. The Dow (DJI: ^DJI - News) is about to encounter two trend lines that go back nearly five years. The resistance clusters for the Nasdaq (Nasdaq: ^IXIC - News), Russell 2000 (NYSEArca: IJR - News), and financials (NYSEArca: XLF - News) are not as glaring but they're there. The only thing that doesn't quite fit into the equation is the euro's sentiment data illustrated above. Nevertheless, the weight of evidence suggests that a turnaround for stocks, and possibly another significant market top, may be just around the corner. The high probability strategy is to short U.S. stocks as soon as the resistance cluster is reached or support is broken. The ETF Profit Strategy Newsletter identifies the target of this rally along with a short, mid and long-term outlook and the corresponding ETF profit strategies.

domingo, 14 de octubre de 2012

Forex FRCN - Stock Moves Over 100%

Forex

I made FRCN a chart to watch and posted about it earlier stating I liked it for a bottom trade: http://pennystockgurus.blogspot.com/2012/06/frcn-bottom-trade.html

BEFORE:

AFTER

sábado, 13 de octubre de 2012

Oil Comments from G20 finance chiefs meeting in Mexico

Oil Comments from G20 finance chiefs meeting in Mexico MEXICO CITY (Reuters) - Following are comments from policymakers attending the meeting of Group of 20 finance ministers and central bankers in Mexico City on Saturday. U.S. TREASURY SECRETARY TIMOTHY GEITHNER 'I think it's important to give Europe's leaders credit for what they have accomplished ... and put in place in terms of the architecture of a credible response in the last four months.' 'They have had a big impact in reducing the downside risks to growth ... though it's important not to rest on that progress.' 'I hope that we're going to see, and I expect we will see, continued efforts by the Europeans ... to put in place a stronger, more credible firewall.' CANADIAN FINANCE MINISTER JIM FLAHERTY 'I do want to encourage Germany to take that leadership role very seriously and come up with an overall euro zone plan.' 'I think that what I'd like to see in the communique is language that indicates that the real question is, when will we see the euro zone plan. And that discussions about other countries through the IMF supporting the euro zone plan should await the answer to the first question.' 'I don't think we're ever going to be able from the outside to impose a deadline on the euro zone. That's up to them.' GERMAN FINANCE MINISTER WOLFGANG SCHAEUBLE 'It does not make any economic sense to follow the calls for proposals which would be mutualizing the interest risk in the euro zone, nor in pumping money into rescue funds, nor in starting up the ECB printing press.' 'I am worried the overriding problems ... have not been tackled sufficiently. We have to be more daring when it comes to these large and fundamental challenges.' 'You know that Greece is a special and unique case...The main difficulty is a serious lack of competitiveness.' JAPANESE FINANCE MINISTER JUN AZUMI 'I'd like to see how Europe will make concrete efforts and then discuss how we can contribute.' 'I said that I expect debate on strengthening of the IMF lending capacity will progress on condition that the problem of Europe's debt crisis is put to an end by the G20 meeting in Washington in April.' 'The present firewall involves strengthening of EFSF and increase of upper cap on ESM. But I said (at G20) that they should be further strengthened.' 'The economy is somewhat picking up in the world as a whole, including Japan, and (we) want to put an end to the Europe crisis in the early spring and to accelerate the global economic growth.' BRAZILIAN FINANCE MINISTER GUIDO MANTEGA 'Emerging countries will only help under two conditions; first that they strengthen their firewall and second for the IMF (quota) reform be implemented.' 'I see most countries sharing a similar opinion that the Europeans have to strengthen their firewall.' JAY COLLINS, SENIOR CITIGROUP EXECUTIVE 'The lack of a firewall decision coming out of Europe takes a toll, speed matters.' 'Speed and urgency is critical.' BANK OF JAPAN GOVERNOR MASAAKI SHIRAKAWA 'Heightening geographical risks and some bright movements in advanced economies after the New Year are factors behind the underlying crude oil price hikes. Of course, monetary easing has been continuing but I don't see it as a major factor for driving up crude oil prices. Generally speaking, we'll closely watch effects and side-effects of monetary easing.' MARK CARNEY, BANK OF CANADA GOVERNOR AND CHAIRMAN OF THE FINANCIAL STABILITY BOARD 'We are cursed with living in extraordinary times. There are two critical challenges that are really facing policymakers at the moment. Restoring growth and stability in Europe. There's been quite appropriately tremendous attention paid to that. But at the same time, just doing that will not be enough.' 'We need to rebuild strong, sustainable, balanced growth in the global economy.' 'One of the issues in these G20 meetings has been that the issue of the moment has often, not surprisingly, crowded out this fundamental medium-term issue.' 'For emerging markets, the weak growth prospects and large accommodative monetary policies in the G3 (major advanced economies) tends to push capital flow towards them, exacerbating concerns about sudden stops and potentially causing a reaction in terms of capital controls.' 'Some emerging markets are reluctant to abandon exchange rate strategies which have served them so well in the past, and so there's a vicious circle here.' BANK OF ITALY GOVERNOR IGNAZIO VISCO 'During the G20 meeting we will discuss the outlook for the global economy and we will probably talk about the developments on the oil markets. Tensions are growing.' 'We have to be vigilant regarding oil.' 'At the moment we don't see the need for a new LTRO by the ECB, but we will have to see the whole effects of the second one (on February 29) before taking a decision.' 'Italy has made remarkable progress on the budget side, now it has to work on growth, even Europe should insist on growth.' OECD SECRETARY-GENERAL ANGEL GURRIA 'The Greek bailout was not a deal, it was an ordeal ... the problem was it came too late.' 'I don't know if Greece's debt target of 120 percent of GDP will be enough -- that will depend on whether Greece delivers on its policies.' 'We have run out of monetary policy room ... we have run out of fiscal room in most countries, some have a little fiscal room now.' 'The ECB's LTRO (long term refinancing operation) is no substitute for a European firewall.' 'It's already six months to a year late... We need a massive European firewall now.' (Compiled by Kieran Murray)

sábado, 22 de septiembre de 2012

Oil Quest for the golden cross

Oil Quest for the golden cross RELATED QUOTES Symbol Price Change MA 348.79 +0.96 XOM 85.83 -0.94 PFE 21.48 -0.15 K 49.73 -0.26 TRI 27.82 -0.10 By Rodrigo Campos NEW YORK (Reuters) - January has turned out strong for equities with just two trading days to go. If you're afraid to miss the ride, there's still time to jump in. You just might want to wear a neck brace. The new year lured buyers into growth-related sectors, the ones that were more beaten down last year. The economy is getting better, but not dramatically. Earnings are beating expectations, but at a lower rate than in recent quarters. Nothing too bad is coming out of Europe's debt crisis - and nothing good, either - at least not yet. 'No one item is a major positive, but collectively, it's been enough to tilt it towards net buying,' said John Schlitz, chief market technician at Instinet in New York. Still, relatively weak volume and a six-month high hit this week make some doubt that the gains are sustainable. But then there's the golden cross. Many market skeptics take notice when this technical indicator, a holy grail of sorts for many technicians, shows up on the horizon. As early as Monday, the rising 50-day moving average of the S&P 500 could tick above its rising 200-day moving average. This occurrence - known as a golden cross - means the medium-term momentum is increasingly bullish. You have a good chance of making money in the next six months if you put it to work in large-cap stocks. In the last 50 years, according to data compiled by Birinyi Associates, a golden cross on the S&P 500 has augured further gains six months ahead in eight out of 10 times. The average gain has been 6.6 percent. That means the benchmark is on solid footing to not only hold onto the 14 percent advance over the last nine weeks, but to flirt with 1,400, a level it hasn't hit since mid-2008. The gains, as expected, would not be in a straight line. But any weakness could be used by long-term investors as buying opportunities. 'The cross is an intermediate bullish event,' Schlitz said. 'You have to interpret it as constructive, but I caution people to take a bullish stance, if they have a short-term horizon .' GREECE, U.S. PAYROLLS AND MOMENTUM Less than halfway into the earnings season and with Greek debt talks over the weekend, payrolls data next week and the S&P 500 near its highest since July, there's plenty of room for something to go wrong. If that happens, the market could easily give back some of its recent advance. But the benchmark's recent rally and momentum shift allow for a pullback before the technical picture deteriorates. 'We bounced off 1,325, which is resistance. We're testing 1,310, which should be support. We are stuck in that range,' said Ken Polcari, managing director at ICAP Equities in New York. 'If over the weekend, Greece comes out with another big nothing, then you will see further weakness next week,' he said. 'A 1 (percent) or 2 percent pullback isn't out of the question or out of line.' On Friday, the S&P 500 (Chicago Options:^INX - News) and the Nasdaq Composite (Nasdaq:^IXIC - News) closed their fourth consecutive week of gains, while the Dow Jones industrial average (DJI:^DJI - News) dipped and capped three weeks of gains. For the day, the Dow dropped 74.17 points, or 0.58 percent, to close at 12,660.46. The S&P 500 fell 2.10 points, or 0.16 percent, to 1,316.33. But the Nasdaq gained 11.27 points, or 0.40 percent, to end at 2,816.55. For the week, the Dow slipped 0.47 percent, while the S&P 500 inched up 0.07 percent and the Nasdaq jumped 1.07 percent. A DATA-PACKED EARNINGS WEEK Next week is filled with heavy-hitting data on the housing, manufacturing and employment sectors. Personal income and consumption on Monday will be followed by the S&P/Case-Shiller home prices index, consumer confidence and the Chicago PMI - all on Tuesday. Wednesday will bring the Institute for Supply Management index on U.S. manufacturing and the first of three key readings on the labor market - namely, the ADP private-sector employment report. Jobless claims on Thursday will give way on Friday to the U.S. government's non-farm payrolls report. The forecast calls for a net gain of 150,000 jobs in January, according to economists polled by Reuters. Another hectic earnings week will kick into gear with almost a fifth of the S&P 500 components posting quarterly results. Exxon Mobil (NYSE:XOM - News), Amazon (NasdaqGS:AMZN - News), UPS (NYSE:UPS - News), Pfizer (NYSE:PFE - News), Kellogg (NYSE:K - News) and MasterCard (NYSE:MA - News) are among the names most likely to grab the headlines. With almost 200 companies' reports in so far, about 59 percent have beaten earnings expectations - down from about 70 percent in recent quarters. (Reporting by Rodrigo Campos; Additional reporting by Chuck Mikolajczak and Caroline Valetkevitch; Editing by Jan Paschal)

miércoles, 19 de septiembre de 2012

Signals FRCN - Stock Moves Over 100%

Signals

I made FRCN a chart to watch and posted about it earlier stating I liked it for a bottom trade: http://pennystockgurus.blogspot.com/2012/06/frcn-bottom-trade.html

BEFORE:

AFTER

martes, 18 de septiembre de 2012

Forex Markets holding gains

Forex

Market continue to hold recent gains. Any small dip is bought. A consolidation near recent high sets the market up for possible upside breakout.

Below the surface the earnings season has created lot of breakouts. Those stocks after small pullbacks are prime candidates for possible upside.

Some of the stocks setting up well are:

ew

wag

hsy

jah

Besides that lot of stocks are also having nice consolidation near high.

Below the surface the earnings season has created lot of breakouts. Those stocks after small pullbacks are prime candidates for possible upside.

Some of the stocks setting up well are:

ew

wag

hsy

jah

Besides that lot of stocks are also having nice consolidation near high.

martes, 11 de septiembre de 2012

Signals Exxon to sell part of Tonen stake for about $3.9 billion:sources

Signals Exxon to sell part of Tonen stake for about $3.9 billion:sources RELATED QUOTES Symbol Price Change TRI 27.82 -0.10 XOM 85.83 -0.94 By Taro Fuse and Emi Emoto TOKYO (Reuters) - Exxon Mobil (NYSE:XOM - News) plans to sell a large part of its 50 percent stake in TonenGeneral Sekiyu KK (:5012.T) back to its Japanese refining partner in a deal that could be worth about 300 billion yen ($3.9 billion), and will make an announcement as early as Monday, four sources with direct knowledge of the matter said. Exxon Mobil will retain about a 20 percent stake in TonenGeneral but the deal will mark a de facto retreat from the world's third-largest economy by the U.S. oil giant, which is focusing its resources on emerging markets and development of natural resources. The move could also spark realignment among Japan's oil refiners, which have been cutting capacity to cope with falling demand caused by a weak economy and a shift to more efficient and environmentally friendly forms of energy, analysts have said. Reuters reported earlier this month that Exxon was in talks to sell part of the stake back to TonenGeneral. TonenGeneral, which imports and distributes Exxon oil in Japan, ranks as the country's No. 2 refiner behind JX Holdings (:5020.T). Smaller rivals include Idemitsu Kosan Co (:5019.T), Cosmo Oil (:5007.T) and Showa Shell (:5002.T). Exxon and TonenGeneral aim to complete the deal around summer, the sources told Reuters on condition of anonymity. TonenGeneral will seek funds from Sumitomo Mitsui Banking Corp, Sumitomo Trust Banking, Bank of Tokyo Mitsubishi UFJ and Mitsubishi Trust Bank to buy back the stake, the sources said. ($1 = 76.7350 Japanese yen) (Reporting by Taro Fuse and Emoto Emi; Writing by Kaori Kaneko; Editing by Chris Gallagher and Ed Lane)

Signals SAGD Running After The Dump

Signals

SAGD had a strong showing today and has made a nice move off its dump lows. We could see the stock move back over $.01 if this momentum and buying pressure continue.

SAGD had a strong showing today and has made a nice move off its dump lows. We could see the stock move back over $.01 if this momentum and buying pressure continue.

Forex France loses AAA-rating in blow to eurozone

Forex PARIS (AP) -- France's finance ministry says Standard & Poor's has cut the country's credit rating by one notch to AA. France's loss of its AAA-rating deals a heavy blow to the eurozone's ability to fight off its debt crisis. The country is the second-largest contributor to the currency union's bailout fund. S&P in December put 15 eurozone countries on creditwatch and other downgrades were expected later Friday. The cut in France's creditworthiness could also hurt President Nicolas Sarkozy's re-election chances. THIS IS A BREAKING NEWS UPDATE. Check back soon for further information. AP's earlier story is below. ROME (AP) -- Europe's ability to fight off its debt crisis was again thrown into doubt Friday when the euro hit its lowest level in over a year and borrowing costs rose on expectations that the debt of several countries would be downgraded by rating agency Standard & Poor's. Stock markets in Europe and the U.S. plunged late Friday when reports of an imminent downgrade first appeared and the euro fell to a 17-month low. The fears of a downgrade brought a sour end to a mildly encouraging week for Europe's heavily indebted nations and were a stark reminder that the 17-country eurozone's debt crisis is far from over. Earlier Friday, Italy had capped a strong week for government debt auctions, seeing its borrowing costs drop for a second day in a row as it successfully raised as much as euro4.75 billion ($6.05 billion). Spain and Italy completed successful bond auctions on Thursday, and European Central Bank president Mario Draghi noted 'tentative signs of stabilization' in the region's economy. A credit downgrade would escalate the threats to Europe's fragile financial system, as the costs at which the affected countries — some of which are already struggling with heavy debt loads and low growth — could borrow money would be driven even higher. The downgrade could drive up the cost of European government debt as investors demand more compensation for holding bonds deemed to be riskier than they had been. Higher borrowing costs would put more financial pressure on countries already contending with heavy debt burdens. In Greece, negotiations Friday to get investors to take a voluntary cut on their Greek bond holdings appeared close to collapse, raising the specter of a potentially disastrous default by the country that kicked off Europe's financial troubles more than two years ago. The deal, known as the Private Sector Involvement, aims to reduce Greece's debt by euro100 billion ($127.8 billion) by swapping private creditors' bonds with new ones with a lower value, and is a key part of a euro130 billion ($166 billion) international bailout. Without it, the country could suffer a catastrophic bankruptcy that would send shock waves through the global economy. Prime Minister Lucas Papademos and Finance Minister Evangelos Venizelos met on Thursday and Friday with representatives of the Institute of International Finance, a global body representing the private bondholders. Finance ministry officials from the eurozone also met in Brussels Thursday night. 'Unfortunately, despite the efforts of Greece's leadership, the proposal put forward ... which involves an unprecedented 50 percent nominal reduction of Greece's sovereign bonds in private investors' hands and up to euro100 billion of debt forgiveness — has not produced a constructive consolidated response by all parties, consistent with a voluntary exchange of Greek sovereign debt,' the IIF said in a statement. 'Under the circumstances, discussions with Greece and the official sector are paused for reflection on the benefits of a voluntary approach,' it said. Friday's Italian auction saw investors demanding an interest rate of 4.83 percent to lend Italy three-year money, down from an average rate of 5.62 percent in the previous auction and far lower than the 7.89 percent in November, when the country's financial crisis was most acute. While Italy paid a slightly higher rate for bonds maturing in 2018, which were also sold in Friday's auction, demand was between 1.2 percent and 2.2 percent higher than what was on offer. The results were not as strong as those of bond auctions the previous day, when Italy raised euro12 billion ($15 billion) and Spain saw huge demand for its own debt sale. 'Overall, it underscores that while all the auctions in the eurozone have been battle victories, the war is a long way from being resolved (either way),' said Marc Ostwald, strategist at Monument Securities. 'These euro area auctions will continue to present themselves as market risk events for a very protracted period.' Italy's euro1.9 trillion ($2.42 trillion) in government debt and heavy borrowing needs this year have made it a focal point of the European debt crisis. Italy has passed austerity measures and is on a structural reform course that Premier Mario Monti claims should bring down Italy's high bond yields, which he says are no longer warranted. Analysts have said the successful recent bond auctions were at least in part the work of the ECB, which has inundated banks with cheap loans, giving them ready cash that at least some appear to be using to buy higher-yielding short-term government bonds. Some 523 banks took euro489 billion in credit for up to three years at a current interest cost of 1 percent. ___ Steinhauser contributed from Brussels. AP Business writer David McHugh in Frankfurt contributed.

lunes, 10 de septiembre de 2012

Earn Student Loan Crisis Looms: FICO Risk Survey

Earn Daily Ticker Despite recent headlines cheering positive trends in the economy, there is still much to be concerned about, according to FICO's new quarterly survey of bank risk professionals. More than two-thirds of risk managers are seriously concerned about the debt loads held by students in the country. 67% of respondents believe delinquencies of student loans will rise, up a considerable 19% from the previous survey. 'They are worried about the amount of student loans that are out there and the ability of those students to repay them,' says Mark Greene, CEO of FICO, which provides credit scores used by both consumers and creditors and is widely considered the industry standard. With tuition prices on the rise each and every year, it is no surprise that the total amount borrowed is also on the upswing. The student who graduated in the class of 2009 had an average of $24,000 in student loans. But that's just the average. Some students are accountable for sums totaling $100,000. (See: The Economic Agony of Today's Twenty-Somethings) The Federal Reserve reported last year that student debt has actually surpassed credit card debt and predicts the total amount owed has topped $1 trillion. Greene's advice to students is: 'Be careful what you borrow.' 'Clearly education has a great return on investment so there is no suggestion you should avoid taking out loans, but be careful what you are getting into,' he says. 'Manage your student loans as carefully as you would your mortgage, your credit card or something else.' Other problem areas listed in the survey include credit card debt and mortgage debt. Credit card debt increased 8.5% to $5.6 billion in November from October, the biggest gain since March 2008. 45% of risk managers surveyed expect credit card delinquencies to rise while 21% expect a decline. And 54% of respondents believe credit card balances will rise. Those figures are more pessimistic than the previous quarter. As for mortgage debt, 47% of risk managers predict mortgage delinquencies will rise while 13% expect to see a decrease. 'If you are looking for risk managers to declare that we've turned the corner, they are not declaring that yet,' says Greene. Do you think the economy is improving or still has a long way to go? More from The Daily Ticker: Forget Harvard and a 4-Year Degree, You Can Make More as a Plumber in the Long Run, Says Prof. Kotlikoff Brain Drain: Most College Students Learn Next to Nothing, New Study Says Jame's Altucher's 8 Alternatives to College Related Quotes: ^GSPC 1,292.18 -0.30 -0.02% BAC 6.76 -0.11 -1.60% C 31.36 +0.09 +0.29% GS 98.96 -0.80 -0.80% JPM 36.44 -0.22 -0.60% WFC 29.54 -0.08 -0.29% PNC 61.51 +0.21 +0.34% FAZ 31.80 +0.23 +0.72% FAS 75.30 -0.53 -0.70% XLF 13.83 -0.04 -0.26% ^DJI 12,432.54 -16.91 -0.14% DFS 26.16 +0.30 +1.16% V 100.99 +1.88 +1.90% MA 342.76 +1.29 +0.38% MS 16.92 -0.18 -1.05%

domingo, 9 de septiembre de 2012

Earn Bloomberg exec in talks to run New Corp's Dow Jones

Earn Bloomberg exec in talks to run New Corp's Dow Jones RELATED QUOTES Symbol Price Change NWSA 18.88 +0.06 TRI.TO 27.80 -0.14 APKN.PK 0.012 0.00 TRI 27.82 -0.10 (Reuters) - Rupert Murdoch's News Corp is in 'serious talks' to poach veteran Bloomberg LP executive Lex Fenwick to run its Dow Jones publishing business, which houses the Wall Street Journal, according to two people familiar with the discussions. Fenwick, who founded Bloomberg Ventures in 2008, was previously chief executive of Bloomberg LP, taking over from the company founder Michael Bloomberg in December 2001. Wall Street Journal reported news of the talks earlier on Friday. The top job at Dow Jones has been vacant since last July when then-Publisher and Chief Executive Les Hinton resigned in the wake of the phone-hacking scandal at News Corp's UK newspaper unit, which had previously run. Hinton told a UK parliamentary inquiry in 2009 that any problem with phone hacking at the company's papers was limited to one case. It was later revealed that thousands of ordinary people and celebrities had been the victims of the voice mail hacking. Hinton, who worked with News Corp for 52 years, was perhaps Murdoch's closest associate. Bloomberg and Dow Jones compete with Thomson Reuters. (Reporting By Yinka Adegoke; Editing by Steve Orlofsky)

martes, 4 de septiembre de 2012

Earn BRICS call for open selection of next World Bank chief

Earn BRICS call for open selection of next World Bank chief MEXICO CITY (Reuters) - A meeting of BRICS major emerging countries discussed the selection process of the next head of the World Bank and emphasized it should be open to all countries, rejecting the tradition that the job automatically goes to an American, a senior BRIC official said on Saturday. The official, speaking after a meeting of the BRICS - Russia, South Africa, Brazil, India and China - said the United States had not circulated the name of its proposed candidate for the World Bank. Asked whether emerging economies could field their own candidate for the post, the official said: 'That is certainly a discussion we will have.' (Reporting By Lesley Wroughton; Editing by Chizu Nomiyama)

domingo, 2 de septiembre de 2012

Oil U.S. did not call for strategic oil release: G20 sources

Oil U.S. did not call for strategic oil release: G20 sources U.S. Treasury Secretary Timothy Geithner (C) and Chairman of Grupo Financiero Banorte Guillermo Ortiz (L) arrive to a meeting of Group of Twenty (G20) leading economies' finance ministers and central bankers in Mexico City February 25, 2012. REUTERS/Tomas Bravo MEXICO CITY, Reuters (Feb 25) - The United States did not openly call for a release of countries' strategic oil reserves during Group of 20 meetings this weekend, Group of 20 sources said on Saturday. Treasury Secretary Timothy Geithner said on Friday the United States is considering a release from its strategic oil reserves as rising tensions between Iran and the West over its disputed nuclear program fueled a rise in oil prices. At meeting of G20 economies on Saturday, two people familiar with the discussion said finance officials had discussed the risk to the world economy from oil prices, which rose above $125 a barrel on Friday, but the United States did not push for a release of strategic reserves. Countries hold oil reserves as a buffer against sudden drops in supply. A draft communique for the G20 meeting, which is still under discussion, said high oil prices were a risk to the global economy, the sources said, although the outlook was cautiously optimistic. 'The communique says that there are some positive signs in the global economy, coming especially from the U.S. economy, but they are tentative,' one G20 official said. (Reporting by Francesca Landini and Dave Graham; Writing by Krista Hughes)

viernes, 31 de agosto de 2012

Oil Utilities to see profit increases in 2012

Oil NEW YORK (AP) -- Shares of power companies appear to be attractive investments this year as the industry invests in new power plants and other infrastructure projects to meet new environmental standards, a Baird analyst said Friday. Analyst David Parker said he expects the industry will spend $750 billion over the next decade to maintain the electrical grid, meet stronger environmental standards and satisfy expanding or changing customer needs. New building projects are a key driver for power company profits because state regulators typically allow utilities to raise power rates and earn a greater return on their investments. Parker favors stocks from NorthWestern Corp. and Allete Inc. Both are expected to lead the industry in profitability in coming years. Northwestern, which delivers electricity and natural gas in Montana, South Dakota and Nebraska, is planning about $2 billion-$3 billion in future projects, including $550-$850 million in near-term opportunities. The near-term projects alone could boost profits by 75 cents to $1.20 per share, Parker said. If its entire project portfolio comes to fruition, it could increase profits by 6 percent-8 percent per year. Allete, which owns and maintains transmission lines in parts of Wisconsin, Michigan, Minnesota and Illinois, also is expected to benefit from new infrastructure growth. Parker expects ALLETE profits to increase by 8 percent-9 percent per year over the next three to five years. Share values for many utilities already have been rising on anticipation of these profit increases. Parker downgraded Alliant Energy Corp., Wisconsin Energy Corp., Hawaiian Electric Industries and UIL Holdings Corp. to 'Neutral' from 'Outperform,' saying their shares have risen to the point that they're now fairly valued. In morning trading, shares of NorthWestern fell by 40 cents to $35 and Allete fell by 15 cents to $40.94. Shares of Alliant fell by 24 cents to $42.68, Wisconsin Energy shares dipped by 25 cents to $34.09, Hawaiian Electric shares fell by 22 cents to $25.73 and UIL Holdings shares dropped by 46 cents to $34.27.

miércoles, 29 de agosto de 2012

Signals 5 Unusual Sales Taxes You Need To Avoid

Signals 5 Unusual Sales Taxes You Need To Avoid With the economy still struggling, states are getting fairly crafty with how they charge consumers via sales taxes. It's no secret that dubious, yet all-too enforceable government laws have been with us since the dawn of the civilized world. In ancient Egypt, the pharaohs taxed cooking oil – of course, the main seller of cooking oil was the pharaoh. During the first century AD, the Roman empire taxed urine – a popular source of ammonia for common tasks like tanning hides and cleaning clothes. Then at the height of the Dark Ages (an era in European history notorious for its poor hygiene), some European governments taxed the sale of soap! Unfortunately, onerous and unusual state taxes are still very much with us. What are some of the biggest offenders – and are they active in your state? Here's our top five: Food Packaging Tax States like Colorado have a weird definition of what constitutes food packaging. In using the term 'essential' in its tax language for such commodities, Colorado finds itself in the strange position of taxing paper cup lids and napkins, but not paper cups or fast-food French fry containers. Hot Air Balloon Tax If you're in Kansas and in the mood to take a ride in a hot air balloon, beware of the state government's 'amusement' tax. State regulation makes balloon rides taxable. But there is a caveat – only balloon rides that are tied, or tethered to the ground, are considered taxable. So, if you want to avoid paying taxes when taking a balloon ride over Topeka, make sure to leave the rope at home! Careful on That Bagel New York State has an interesting way of handling bagels – and taxes on buying bagels. If you want to eat a bagel tax-free, don't have the deli counter 'prepare' it for you (i.e., add cream cheese or cut the bagel in two pieces). Prepare that bagel yourself, and you don't have to pay a tax on it. Wet Fuse In West Virginia, celebrating the Fourth of July – or any celebration where fireworks are used, can lighten your wallet. The state has a special tax – on top of its 6% sales tax – on things like ladyfingers and sparklers. Fruit Cakes California has gone bananas over the purchase of fruit by consumers. If you buy an apple from a regular retailer, you're in good shape, as the purchase is tax-exempt. If you buy fruit from a vending machine – and who hasn't done that – you'll pay an additional 33% on the amount of the purchase. Maybe the most egregious case of over-taxation on a state level comes from Pennsylvania, where the commonwealth actually taxes the use of air (on carwash vacuum cleaners). The Bottom Line The above taxes certainly aren't the only taxes on statewide level, but they are surely among the most unique. This site has a more complete list of sales taxes in all 50 states: http://retirementliving.com/RLtaxes.html .

martes, 28 de agosto de 2012

Forex Germany wants Greece to give up budget control

Forex Germany wants Greece to give up budget control RELATED QUOTES Symbol Price Change TRI 27.82 -0.10 Related Content A Greek national flag flies at the archaeological site of the Acropolis Hill in Athens November 3, 2011. REUTERS/John Kolesidis A Greek national flag flies at the archaeological site of the Acropolis Hill in Athens November 3, 2011. REUTERS/John Kolesidis By Noah Barkin BERLIN (Reuters) - Germany is pushing for Greece to relinquish control over its budget policy to European institutions as part of discussions over a second rescue package, a European source told Reuters on Friday. 'There are internal discussions within the Euro group and proposals, one of which comes from Germany, on how to constructively treat country aid programs that are continuously off track, whether this can simply be ignored or whether we say that's enough,' the source said. The source added that under the proposals European institutions already operating in Greece should be given 'certain decision-making powers' over fiscal policy. 'This could be carried out even more stringently through external expertise,' the source said. The Financial Times said it had obtained a copy of the proposal showing Germany wants a new euro zone 'budget commissioner' to have the power to veto budget decisions taken by the Greek government if they are not in line with targets set by international lenders. 'Given the disappointing compliance so far, Greece has to accept shifting budgetary sovereignty to the European level for a certain period of time,' the document said. Under the German plan, Athens would only be allowed to carry out normal state spending after servicing its debt, the FT said. 'If a future (bail-out) tranche is not disbursed, Greece cannot threaten its lenders with a default, but will instead have to accept further cuts in primary expenditures as the only possible consequence of any non-disbursement,' the FT quoted the document as saying. The German demands for greater control over Greek budget policy come amid intense talks to finalize a second 130 billion-euro rescue package for Greece, which has repeatedly failed to meet the fiscal targets set out for it by its international lenders. CHAOTIC DEFAULT THREAT Greece needs to strike a deal with creditors in the next couple of days to unlock its next aid package in order to avoid a chaotic default. 'No country has put forward such a proposal at the Eurogroup,' a Greek finance ministry official said on condition of anonymity, adding that the government would not formally comment on reports based on unnamed sources. The German demands are likely to prompt a strong reaction in Athens ahead of elections expected to take place in April. 'One of the ideas being discussed is to set up a clearly defined priorities on reducing deficits through legally binding guidelines,' the European source said. He added that in Greece the problem is that a lot of the budget-making process is done in a decentralized manner. 'Clearly defined, legally binding guidelines on that could lead to more coherence and make it easier to take decisions - and that would contribute to give a whole new dynamic to efforts to implement the program,' the source said. 'It is clear that talks on how to help Greece get back on the right track are continuing,' the source said. 'We're all striving to achieve a lasting stabilization of Greece,' he said. 'That's the focus of what all of us in Europe are working on right now.' (Reporting By Noah Barking; Additional reporting by George Georgiopoulos in Athens and; Adrian Croft in London; writing by Erik Kirschbaum; editing by Andrew Roche)

jueves, 23 de agosto de 2012

Signals Consumer Comfort Highest in Six Months

Signals Consumer Comfort Highest in Six Months Consumer confidence in the U.S. last week reached the highest level since July as the improving job market helped allay pessimism. The Bloomberg Consumer Comfort Index was minus 44.7 in the period ended Jan. 8 from minus 44.8 the prior week. As recently as October, the index registered its lowest readings since the 2007-2009 recession, making 2011 the second-worst year in 25 years of data. It's since increased in four of the past five weeks. 'Considering where it's been, the trend is a welcome one,' Gary Langer, president of Langer Research Associates LLC in New York, which compiles the index for Bloomberg, said in a statement. 'Sentiment is hardly on a predictable path, given factors including the uncertainty of the 2012 presidential election, volatility in global markets and economic question marks from Europe to China.' Less unemployment and growing payrolls may be lifting consumers' moods, providing the spark for increases in consumer spending, which accounts for about 70 percent of the economy. Nonetheless, gasoline prices that are once again rising and wage gains that fail to keep pace with inflation may be obstacles to greater improvement in confidence. Other reports today showed retail sales rose less than forecast in December and claims for jobless benefits climbed more than projected in the first week of the year. Retail Sales Purchases increased 0.1 percent last month after a 0.4 percent advance in November that was more than initially reported, Commerce Department figures showed. Economists forecast a 0.3 percent December rise, according to the median estimate in a Bloomberg News survey. Purchases excluding automobiles fell 0.2 percent, the first decline since May 2010. The number of applications for unemployment benefits climbed by 24,000 to 399,000 in the week ended Jan. 7, Labor Department figures showed. The median forecast of 46 economists in a Bloomberg survey projected 375,000. Stocks rose as sales of government securities in Spain and Italy eased concern the countries would struggle to finance their debts. The Standard & Poor's 500 Index climbed 0.1 percent to 1,293.76 at 9:40 a.m. in New York. The comfort survey's gauge of Americans' views of the current state of the economy rose to minus 82.1 last week from minus 82.9 in the prior period. The buying climate index held at minus 49.4, and the measure of personal finances decreased to minus 2.6 from minus 2.2. The gain in the cumulative Bloomberg index last week was within the survey's three-point margin of error. More Jobs Better employment opportunities are probably holding up confidence. Payrolls increased by 200,000 in December, and the jobless rate dropped to 8.5 percent, the lowest since February 2009, a Labor Department report showed last week. Employers added 1.64 million workers in 2011, surpassing the prior year's 940,000 advance and the biggest gain since 2006. Sentiment has been improving among lower-income Americans. The index for those earning less than $15,000 per year increased to the highest level since October, and those making up to $24,999 were the most optimistic since February. The ebbing of pessimism was also evident among older households. The measure of confidence among those older than 65 rose to minus 39.9, the best reading since April. Brighter moods may help drive consumer spending in 2012 following the holiday shopping season. 'Extremely Pleased' 'We are extremely pleased with our December sales results as we significantly exceeded our expectations,' Sherry Lang, a spokeswoman for TJX Cos. said in Jan. 5 conference call. Sales at the Framingham, Massachusetts-based retailer increased 8 percent last month. 'Further, we entered January with very lean inventories and the flexibility to ship fresh merchandise at great values to our stores.' The gain in the Bloomberg index parallels improvement in other surveys. The Conference Board's confidence gauge increased in December to the highest level since April. That same month the Thomson Reuters/University of Michigan index of consumer confidence rose to the highest level since June. Nonetheless, rising gasoline prices may constrain sentiment. The cost of a regular gallon of fuel at the pump climbed to $3.38 yesterday, up 5.5 percent from a 10-month low reached on Dec. 20, according to data from AAA, the nation's largest auto group. 'While the recent trend in consumer confidence is encouraging, risks remain,' said Joseph Brusuelas, a senior economist at Bloomberg LP in New York. 'The recent rise in gasoline prices is likely to act as a restraint on improving consumer confidence in January.' Annual Averages Bloomberg's comfort index, which began in December 1985, averaged minus 46.8 for all of last year, second only to 2009's minus 47.9 as the worst year on record. The gauge averaged minus 45.7 for 2010. The Consumer Comfort Index is based on responses to telephone interviews with a random sample of 1,000 consumers 18 years old and over. Each week, 250 respondents are asked for their views on the economy, personal finances and buying climate; the percentage of negative responses for each measure is subtracted from the share of positive views. The results are then summed and divided by three. The most recent reading is based on the average of responses over the previous four weeks. The comfort index can range from 100, indicating every participant in the survey had a positive response to all three components, to minus 100, signaling all views were negative. Field work for the index is done by SSRS/Social Science Research Solutions in Media, Pennsylvania. To contact the reporter on this story: Alex Kowalski in Washington at akowalski13@bloomberg.net To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net

Suscribirse a:

Entradas (Atom)